how to file a lien in alabama

Must file within 30 days of the date labor was last provided Original Contractors. The amount of tax due must be paid.

Arizona Mechanic S Lien Requirements 48 7810 Dr Note For Work Car Title Document Templates

Filing a construction lien on residential projects requires filing a Notice of Unpaid Balance and Right to File Lien within 90 days of the last day of.

. After providing notice to the owner the deadlines to file a lien are as follows. Must file within 6 months after the. However the extension of time for filing the return is not an extension of time for payment of tax.

Automatic Six-Month Extension to File Form 65 and Form PTE-C The Alabama Department of Revenue is now following IRS filing and extension dates. Construction pros want to know their recourse options if theyre having trouble collecting payment. The basic rule is that anyone who provides labor or materials to a permanent improvement on real.

The deadline to file an Alabama mechanics lien is dependent upon the status of the lien claimant and contingent upon first providing notice to the property owner. A six month extension of time for filing Form 65 and Form PTE-C will be granted automatically. Owners want to know if a contractor subcontractor or supplier has the right to file a lien especially when someone theyve never heard of filed a lien on their property.

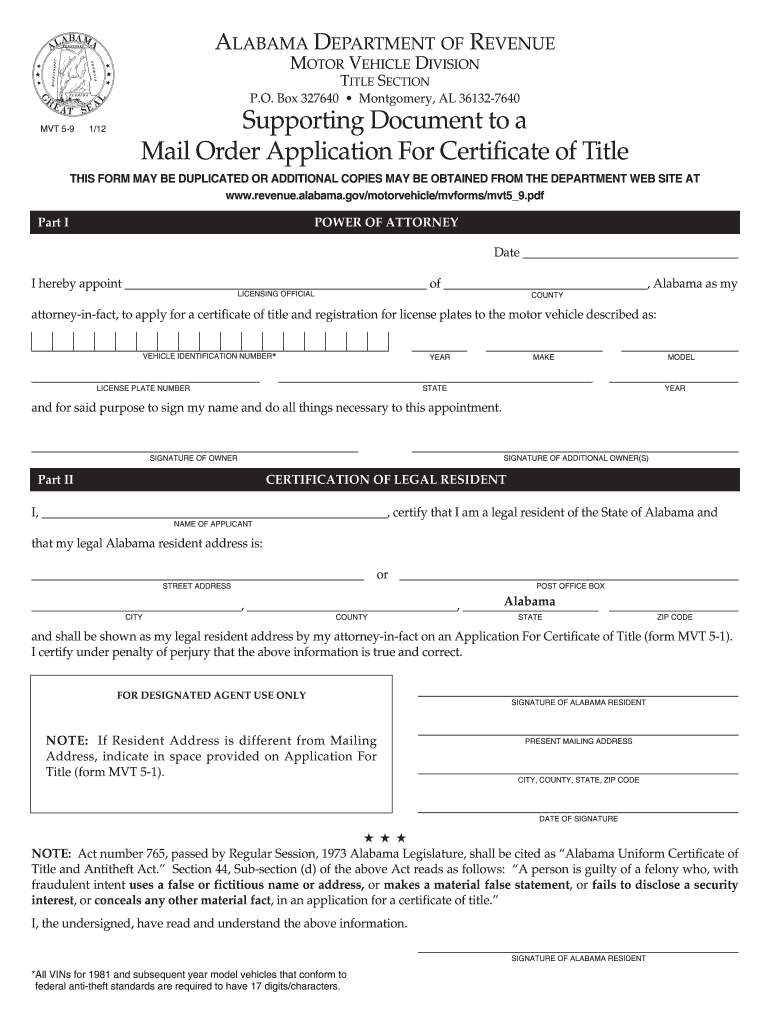

Alabama Title Application Fill Online Printable Fillable Blank Pdffiller

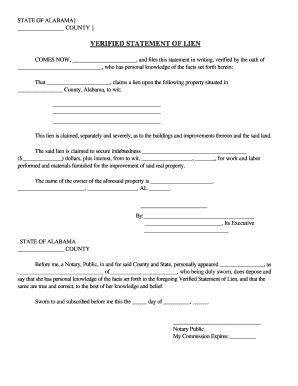

Lien Release Form Alabama Fill Out And Sign Printable Pdf Template Signnow

Car Bill Of Sale Printable Bill Of Sale Template Bill Of Sale Car Bill Template

Alabama Payment Terms Faqs Info On Clauses Forms And More

Alabama Lien Release Fill Online Printable Fillable Blank Pdffiller

Alabama Notice Of Unpaid Balance Faqs Guide Forms Resources

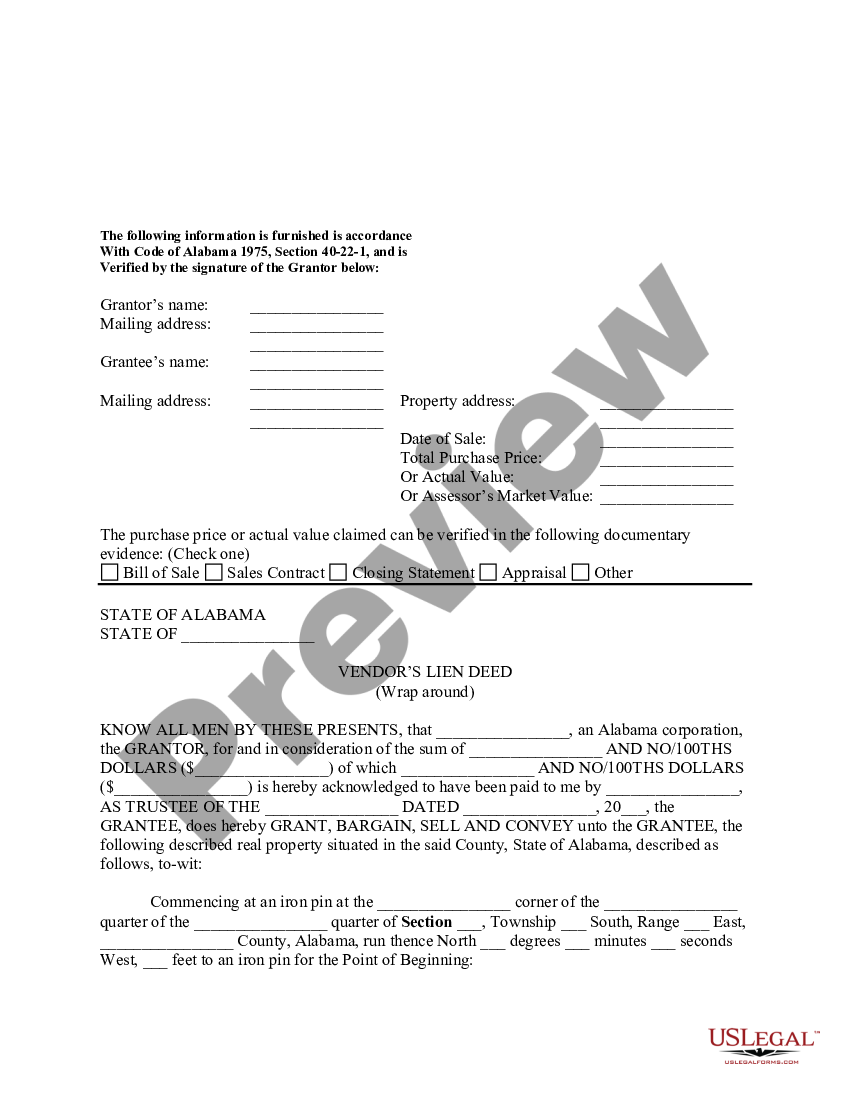

Alabama Vendor S Lien Deed Alabama Lien Us Legal Forms

How To File An Alabama Mechanics Lien Step By Step Walkthrough